Introduction

Life is full of uncertainties. A sudden illness, accident, loss of property, or unexpected death can turn years of savings into financial struggle within days. This is where insurance planning becomes essential. Insurance is not just a financial product—it is a long-term strategy that protects your income, assets, and loved ones against unforeseen risks.

In this article, we explore insurance planning in depth, including its importance, types, advantages, and how it fits into smart financial management.

Understanding Insurance Planning

Insurance planning is the process of identifying potential risks in life and choosing appropriate insurance policies to reduce their financial impact. It ensures that your financial goals—such as children’s education, home ownership, retirement, and family security—remain protected even during difficult times.

Good insurance planning focuses on protection first, not just returns.

Why Insurance Planning Is Essential Today

1. Rising Medical Costs

Healthcare expenses are increasing every year. Without insurance, a single hospitalization can wipe out years of savings.

2. Unstable Income Sources

Job loss, business slowdown, or disability can suddenly affect income. Insurance provides financial continuity.

3. Lifestyle Risks

Modern lifestyles increase the risk of stress-related illnesses, accidents, and chronic diseases.

4. Long-Term Financial Commitments

Loans, EMIs, education costs, and family responsibilities make insurance a necessity, not a luxury.

Major Categories of Insurance

Life Insurance: Income Protection for Family

Life insurance ensures that your family can maintain their lifestyle even if you are no longer there to support them financially.

Ideal For:

- Salaried professionals

- Business owners

- Parents with dependents

- Loan holders

It replaces lost income and protects long-term goals.

Health Insurance: Shield Against Medical Inflation

Health insurance covers expenses related to hospitalization, surgeries, medicines, and treatments.

Why It’s Critical:

- Medical inflation is rising faster than income

- Employer insurance may not be sufficient

- Serious illness can cause long-term financial damage

A good health policy protects both health and savings.

General Insurance: Protection for Assets

General insurance covers non-life risks such as vehicles, homes, travel, and businesses.

Examples:

- Motor insurance

- Home insurance

- Travel insurance

- Business insurance

These policies safeguard valuable assets from damage, theft, or legal liability.

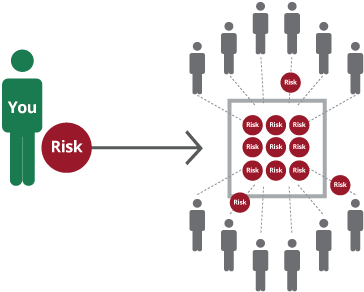

Insurance as a Financial Safety Net

Insurance works on the principle of risk sharing. Many individuals contribute small amounts (premiums), and those who face loss receive financial support. This system prevents a single person from bearing the full burden of a major loss.

Insurance complements savings and investments by providing certainty during uncertainty.

Common Mistakes People Make with Insurance

❌ Buying insurance only for tax saving

❌ Choosing low coverage to save premium

❌ Relying only on employer-provided insurance

❌ Not reading policy exclusions

❌ Delaying insurance purchase

Avoiding these mistakes can significantly improve financial stability.

How Much Insurance Coverage Is Enough?

Life Insurance Coverage

A general rule is 10–15 times your annual income, adjusted for loans and future expenses.

Health Insurance Coverage

Coverage should be sufficient to handle major medical emergencies without touching savings.

Adequate coverage is more important than cheap premiums.

Insurance and Wealth Protection

Insurance protects wealth, while investments grow wealth. Both are equally important.

- Insurance handles risk

- Investments handle returns

A balanced financial plan includes both, ensuring stability and growth.

Digital Insurance: The Modern Advantage

With online platforms, buying insurance has become easier than ever.

Benefits of Online Insurance:

- Easy comparison

- Lower premiums

- Transparent policy details

- Faster claim processing

Digital insurance empowers consumers to make informed choices.

The Role of Insurance in Long-Term Financial Planning

Insurance plays a foundational role in financial planning by:

- Protecting income

- Securing dependents

- Supporting retirement planning

- Reducing financial anxiety

- Ensuring goal continuity

Without insurance, even the best investment plan remains incomplete.

Conclusion

Insurance planning is not about expecting the worst—it is about being prepared for it. It ensures that life’s uncertainties do not destroy your financial future. Whether it is protecting your health, income, assets, or loved ones, insurance provides strength, security, and peace of mind.

A well-insured individual is financially confident, resilient, and prepared for any challenge life may present.

Remember:

👉 You can rebuild wealth, but protecting life and health must come first.