Introduction

Many people believe insurance is something they can buy later—after earning more, after getting married, or after starting a family. Unfortunately, life does not wait for the “right time.” Accidents, illnesses, and financial emergencies can occur without warning. Insurance awareness is the first step toward building a secure and stress-free future.

This article focuses on why insurance is essential for everyone, how it protects against real-life risks, and how early awareness can prevent long-term financial hardship.

The Reality of Financial Risks

Financial risks exist at every stage of life. A young professional may face health emergencies, a middle-aged individual may struggle with loans and family responsibilities, while seniors may face rising medical costs. Without insurance, these risks can destroy savings built over many years.

Insurance acts as a financial shock absorber, reducing the impact of sudden expenses.

What Insurance Truly Protects

Insurance does not only cover money—it protects:

- Your family’s lifestyle

- Your long-term goals

- Your mental peace

- Your savings and investments

- Your ability to recover after loss

When chosen correctly, insurance becomes a silent supporter during the toughest moments of life.

Key Insurance Policies Everyone Should Know About

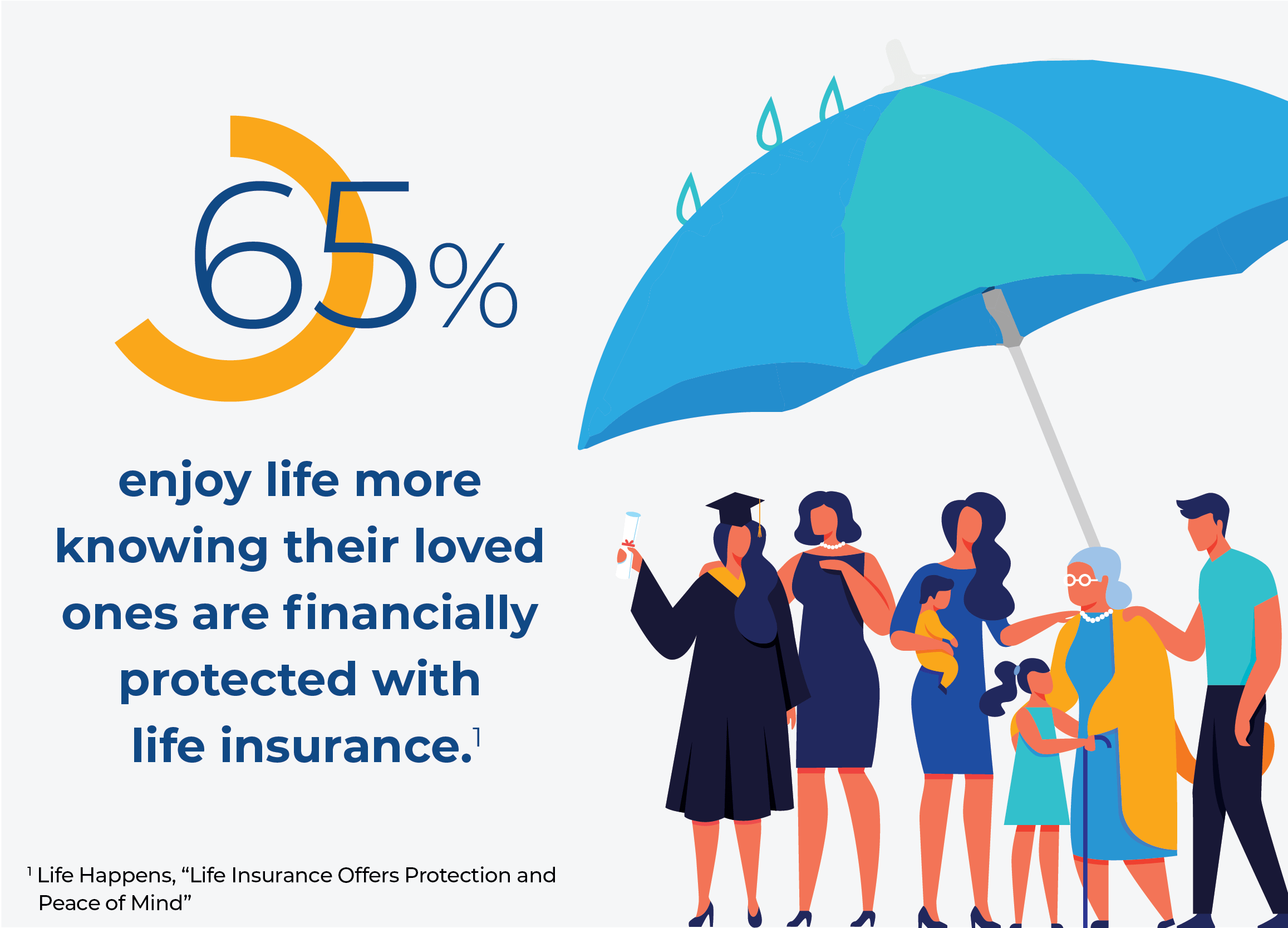

Life Insurance: Protection Beyond Income

Life insurance ensures that your dependents are financially secure even if your income stops permanently. It helps families manage daily expenses, repay loans, and continue future plans without compromise.

Health Insurance: Your Defense Against Medical Inflation

Healthcare costs are rising faster than income growth. Health insurance ensures that medical treatment does not become a financial burden, allowing you to focus on recovery rather than hospital bills.

Motor Insurance: Safety on the Road

Motor insurance protects against accident-related expenses, vehicle damage, theft, and third-party legal liabilities. It is not only a legal requirement but also a financial necessity.

Property Insurance: Securing Your Biggest Asset

Your home and property represent years of effort and savings. Property insurance protects against damage caused by natural disasters, fire, and unforeseen events.

Insurance vs Savings: Understanding the Difference

Many people rely solely on savings to handle emergencies. However:

- Savings are limited

- Insurance offers large coverage at low cost

- Insurance protects savings from being exhausted

Savings help in planned expenses, while insurance protects against unplanned disasters. Both are essential, but insurance comes first.

The Cost of Not Having Insurance

The absence of insurance can lead to:

- High debt and loans

- Liquidation of investments

- Reduced quality of life

- Financial dependence on others

- Long-term emotional stress

Insurance helps avoid these situations by providing timely financial support.

Why Buying Insurance Early Matters

Buying insurance early offers multiple advantages:

- Lower premiums

- Better coverage

- Fewer medical restrictions

- Long-term financial stability

Early planning builds a strong foundation for future security.

Insurance and Responsible Financial Behavior

Insurance promotes financial discipline by encouraging:

- Risk assessment

- Goal-oriented planning

- Long-term thinking

- Family responsibility

It is a sign of financial maturity, not fear.

Common Misunderstandings About Insurance

❌ “I’m young, I don’t need insurance”

❌ “Insurance is too expensive”

❌ “My savings are enough”

❌ “Claims are difficult”

In reality, insurance is affordable, accessible, and reliable when chosen wisely.

How to Become an Informed Insurance Buyer

- Understand your financial responsibilities

- Compare policies, not just premiums

- Check claim settlement reputation

- Read terms and exclusions carefully

- Review policies periodically

Informed decisions lead to better protection.

Conclusion

Insurance is not about predicting problems—it is about preparing for them. Awareness and early action can protect you from financial shocks that might otherwise change your life permanently.

In a world full of uncertainty, insurance provides certainty, stability, and peace of mind.

The best insurance policy is the one you buy before you need it.