Introduction

Modern life demands more than just earning money—it requires the ability to protect what you earn. Financial literacy today is incomplete without understanding insurance. Insurance is not merely a product sold by companies; it is a life skill that helps individuals survive financial shocks and maintain stability during uncertain times.

This article explains how insurance functions as a core life skill, why it is essential for every individual, and how it strengthens long-term financial well-being.

Insurance: More Than a Financial Product

Insurance is often misunderstood as an unnecessary expense or a forced obligation. In reality, insurance is a structured system that protects individuals from risks that are too large to handle alone.

It converts:

- Large, unpredictable losses

- Into small, manageable payments

This simple principle makes insurance one of the most powerful financial tools ever created.

Why Insurance Knowledge Is Essential for Everyone

4

Risks do not discriminate based on age, income, or profession. Everyone faces exposure to:

- Health emergencies

- Accidents and injuries

- Property damage

- Loss of income

- Legal liabilities

Insurance knowledge allows individuals to respond to these risks calmly instead of reacting in panic.

Insurance Builds Financial Discipline

Insurance teaches several important financial habits:

- Planning for uncertainty

- Prioritizing protection over luxury

- Budgeting premiums responsibly

- Thinking long-term instead of short-term

People who understand insurance tend to make better financial decisions overall.

Core Areas Where Insurance Protects Life Stability

4

Health Protection

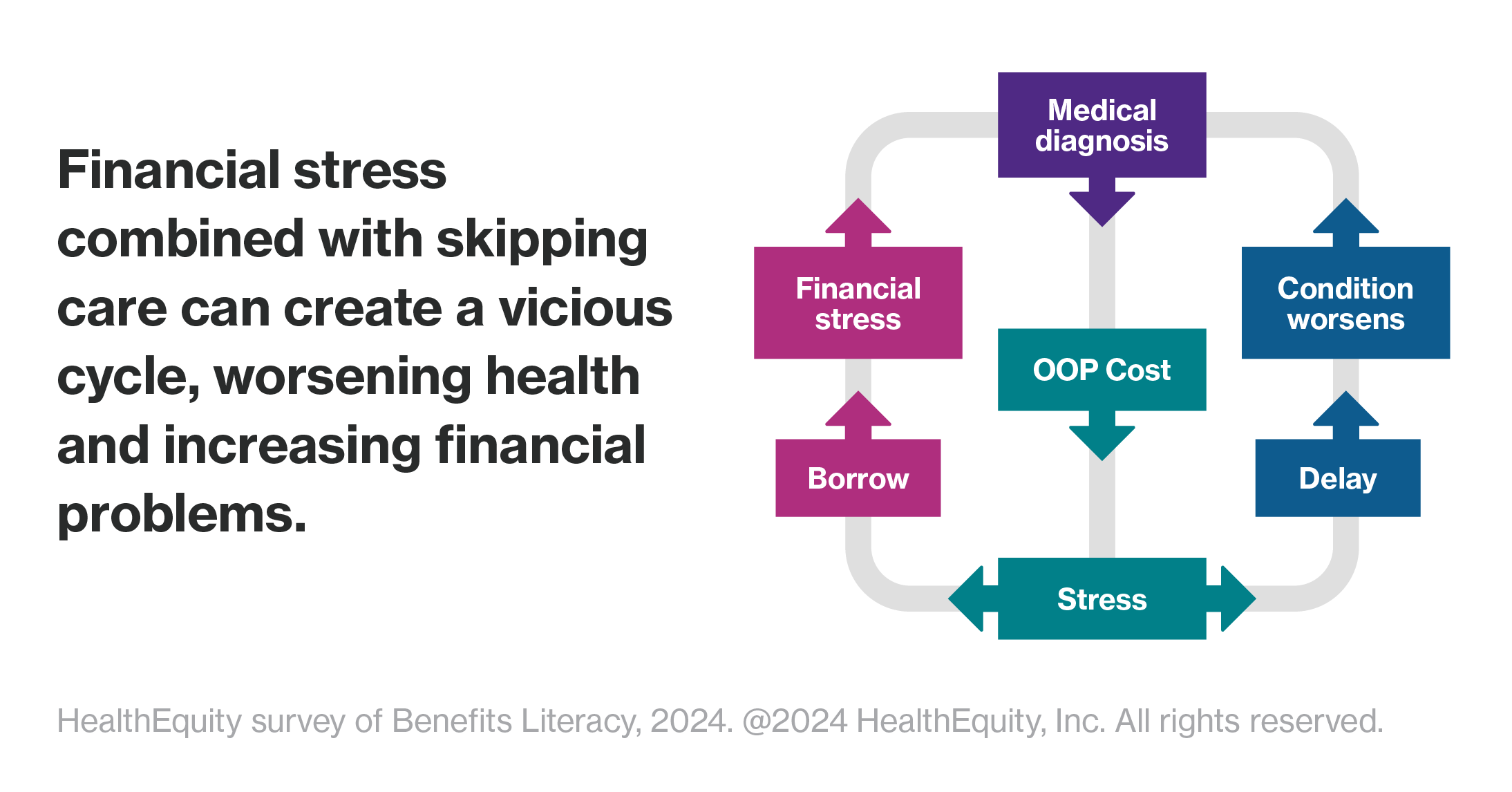

Health insurance prevents medical emergencies from becoming financial disasters. It ensures access to quality healthcare without exhausting savings.

Income Protection

Life and disability insurance ensure that dependents are not financially helpless if the primary earner is no longer able to work.

Asset Protection

Vehicles, homes, and businesses represent years of effort. Insurance shields these assets from accidents, disasters, and legal claims.

Insurance vs Luck: Why Preparation Wins

Some people rely on luck, assuming serious problems will never happen to them. History proves otherwise. Preparation always beats hope.

Insurance allows you to:

- Recover faster after loss

- Avoid debt traps

- Preserve long-term goals

- Maintain dignity and independence

Luck may fail, but preparation rarely does.

The Psychological Value of Insurance

Insurance reduces emotional stress during emergencies by removing financial uncertainty. When expenses are covered, people can focus on:

- Recovery

- Decision-making

- Family support

Mental peace is one of the most underrated benefits of insurance.

Common Reasons People Delay Insurance

Despite its importance, many people delay insurance due to:

- Overconfidence in good health

- Misunderstanding of costs

- Belief that insurance is complicated

- Dependence on savings or employer coverage

Delaying insurance often increases cost and reduces coverage options later.

Why Insurance Should Come Before Investments

Many people prioritize investments before insurance. This is a mistake.

- Insurance protects capital

- Investments grow capital

Without insurance, investments may need to be sold during emergencies, leading to losses. Insurance creates a stable foundation on which investments can safely grow.

How Insurance Supports Long-Term Goals

Insurance ensures that goals such as:

- Children’s education

- Home ownership

- Business growth

- Retirement security

remain achievable even after unexpected setbacks.

Becoming a Responsible Insurance User

To use insurance effectively:

- Understand your risks

- Buy adequate coverage

- Review policies regularly

- Avoid underinsurance

- Stay informed about policy terms

Insurance works best when treated as a long-term partnership, not a one-time purchase.

Insurance in a Changing World

With rising healthcare costs, climate risks, and economic uncertainty, insurance is becoming more important than ever. Digital platforms and online tools have made insurance more accessible, transparent, and affordable for individuals worldwide.

Insurance is evolving, but its core purpose remains the same: protection against uncertainty.

Conclusion

Insurance is not about fear—it is about responsibility. It reflects care for oneself, for family, and for the future. Treating insurance as a life skill rather than a product changes how people approach financial planning.

In an unpredictable world, insurance provides stability, confidence, and resilience.

You cannot control risks, but you can control how prepared you are for them.